Fraud Analytics: Key Tools and Techniques for Detection

Explore fraud analytics in banking, insurance, healthcare, and retail. Learn key tools, techniques, workflows, and real-time detection with Excel, SQL, Python, Tableau, and big data platforms for effective fraud prevention.

A robust economy relies on the trust shared between buyers and sellers. When that trust is compromised, the cost of conducting business rises. Fraudulent actors exploit vulnerabilities by engaging in deceptive transactions, while organized groups of fraudsters often target specific industries.

This article explores the various types of fraud identified through analytics, the key techniques employed for detection, typical workflows in fraud detection, and the essential software tools that power effective fraud analytics.

Fraud severely impacts revenue and trust; organizations now use fraud analytics software with data-driven methods to detect and prevent suspicious activities.

What is fraud analytics?

Fraud analytics refers to the use of statistical analysis, machine learning, and data mining to detect, prevent, and investigate fraudulent activities. By analyzing large volumes of data, organizations can identify anomalies that signal fraud, whether in insurance fraud, healthcare fraud, or payment fraud in retail. Identifying fraudulent activity is challenging because:

- Fraudsters deploy sophisticated methods to disguise fraudulent activities as legitimate, requiring advanced fraud detection tools and statistical techniques to identify anomalies.

- Fraudulent transactions represent only a small fraction of total transactions, making automated fraud analytics systems crucial for identifying high-risk activities efficiently.

Unlike traditional auditing methods, fraud analytics offers real-time monitoring and predictive capabilities. This makes it an essential part of financial services, insurance companies, and e-commerce firms aiming to safeguard transactions. The following tools are commonly used by data analysts for detecting and preventing fraud.

Refer to the articles below:

- Impact of Cloud Computing and Big Data Analytics on Industries

- Understanding the Ethics of Data Analytics

- 6 Innovative Ways to Leverage AI in Data Analytics

Key tools and techniques for fraud detection

Organizations utilize a combination of fraud analytics tools and methodologies to identify fraudulent activity. These data analyst tools span from basic spreadsheet applications to advanced big data platforms and specialized fraud analytics software.

1. Excel for fraud analytics

Microsoft Excel remains one of the simplest yet widely used tools in fraud detection. Its functions allow analysts to perform quick data analysis, apply conditional formatting, and run pivot tables to spot irregular transactions. In many small and mid-sized organizations, Excel serves as the first step in implementing fraud analytics techniques before scaling to advanced systems.

2. SQL for detecting fraud

Structured Query Language (SQL) is indispensable in querying and managing databases. With SQL, fraud investigators can extract specific transaction records, detect duplicate claims, and identify unusual spending behaviors. For fraud analytics in banking, SQL queries are often used to monitor suspicious account activity or trace patterns in money laundering cases.

3. Python & R for advanced fraud analytics

For advanced fraud analytics techniques, programming languages like Python and R provide powerful libraries for statistical modeling and machine learning. Python’s libraries such as Scikit-learn and Pandas, along with R’s data analysis packages, are widely employed in predictive modeling. These tools are crucial for insurance companies detecting staged accidents or healthcare fraud cases such as inflated billing.

4. Tableau for fraud visualization

Tableau, a leading data visualization tool, enables analysts to create interactive dashboards that highlight anomalies and risk indicators. Visual analytics enhances decision-making by allowing stakeholders to see patterns in large datasets, making it highly effective in monitoring fraud analytics in banking and insurance fraud detection.

5. Big data tools for scalable fraud detection

With massive transaction data generated daily, big data analytics comes into play the popular platforms like Hadoop and Spark have become essential. These tools allow real-time fraud monitoring at scale, making them crucial for industries like banking, retail, and healthcare. Fraud analytics software built on big data technologies provides faster insights, reducing the lag between fraud occurrence and detection.

These key tools and techniques integrate seamlessly into a structured fraud analytics workflow, let's see how to enable organizations to efficiently collect, preprocess, analyze, and monitor data for accurate and timely fraud detection.

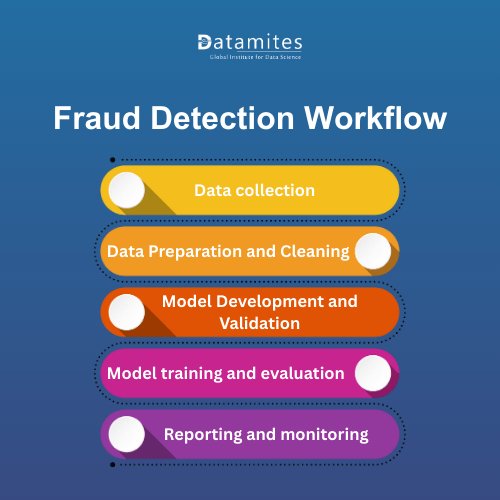

Fraud detection workflow

Fraud detection follows a structured workflow, ensuring accuracy and reliability in identifying fraudulent behavior.

1. Data Collection for Fraud Detection

Fraud detection relies heavily on analyzing large datasets to identify unusual patterns and behaviors. High-quality, well-curated datasets—such as transaction records, customer profiles, and third-party sources—are critical for training fraud detection models.

- Transaction logs capture details like transaction amounts, frequency, volumes, IP addresses, and timestamps, which help uncover irregularities.

- Customer databases store valuable information such as addresses, payment methods, browsing and purchase histories, reviews, and product returns.

- Third-party data sources or External data sources supplement internal datasets and help verify existing insights, thereby improving overall accuracy.

2. Data Preprocessing and Cleaning

Once collected, raw data must be refined before being used in model training. This process guarantees that the dataset is accurate, consistent, and prepared for effective analysis.

- Data preparation for data analysis by cleaning the data and removing duplicates, fixes formatting issues (e.g., numbers stored as text), fills missing values, and eliminates incorrect entries that could compromise model performance.

- Data normalization standardizes numerical values on a consistent scale and may convert categorical data into numeric formats. This becomes essential when merging datasets from multiple sources.

- Feature engineering transforms existing information into new variables that improve a model’s predictive accuracy.

3. Model training and evaluation

Machine learning algorithms form the core of modern fraud analytics techniques. Using historical data, models are trained to detect fraudulent transactions or suspicious user profiles.

Accuracy is crucial not only must fraudulent activity be flagged, but legitimate transactions must proceed without disruption. Excessive false positives (flagging genuine transactions as fraud) harm customer experience. To avoid this, trained models are evaluated against performance metrics to ensure a balanced outcome.

4. Real-time fraud detection

Fraud prevention is most effective when suspicious activity is identified before a transaction is finalized. Real-time fraud detection integrates fraud analytics directly into transaction systems, minimizing losses.

- Streaming data pipelines (e.g., Apache Kafka) send live transaction data into fraud detection systems, enabling immediate alerts and validations before confirming transactions.

- Embedded analytics within transaction systems (e.g., Apache Flink) perform stream processing with machine learning models in real time, ensuring proactive fraud prevention.

5. Reporting and monitoring

Monitoring and reporting are critical to track the success of fraud prevention strategies and support informed decision-making.

- Dashboards present real-time insights such as fraudulent transaction counts, financial losses, and system performance metrics in a clear visual format.

- Alerts notify compliance teams or fraud analysts instantly when suspicious activity is detected, enabling swift intervention.

- Automated reports provide periodic summaries of fraud detection performance, supporting long-term monitoring and adjustments.

Customer notifications ensure users are informed about suspicious activity on their accounts, whether to verify legitimate actions or to confirm account suspensions for security reasons.

By combining data, machine learning, and real-time monitoring, fraud detection workflows empower organizations to stay resilient against evolving threats. Few applications across industries are mentioned below.

Refer to the articles below:

- How much will be the Data Analytics Course Fees in Mumbai

- Data Analyst Course Fee in Chennai

- Data Analyst Course Fee in Hyderabad

Applications of fraud analytics across industries

Fraud analytics has become an essential safeguard across industries, with specialized fraud analytics tools tailored to detect sector-specific risks and enhance security. Cisco's 2024 Cybersecurity Readiness Index reports that 54% of organizations faced a cyber incident last year, with 73% anticipating one in the next 12–24 months. Only 3% of organizations are considered to have fully mature cybersecurity readiness.

Fraud analytics in banking & finance

In the financial sector, fraud analytics in banking plays a critical role in combating credit card fraud, identity theft, and suspicious loan applications. By using fraud analytics software and real-time monitoring systems, banks can quickly identify abnormal transaction patterns and prevent large-scale money laundering through network analysis and predictive modeling.

- Data Analytics in Finance helps combat payment fraud by monitoring unusual transactions that deviate from normal account activity. It also flags payments originating from suspicious IP addresses and device IDs to prevent fraudulent activity.

Fraud analytics in insurance

Insurance fraud continues to be one of the biggest challenges for global insurance companies. Fraud analytics helps detect exaggerated damages, duplicate claims, and staged accidents by analyzing claim histories and comparing them with standard patterns. These fraud analytics techniques speed up genuine claim settlements while flagging high-risk claims for deeper investigation.

- Fraud analytics in insurance detects false claims, inflated damages, and premium evasion by cross-checking data, validating applications, and analyzing suspicious patterns.

- It also helps detect counterfeit insurance policies, assisting insurers and law enforcement in exposing fraudulent policy schemes.

Fraud analytics in E-commerce & retail

In the retail space, fraudulent activities such as fake customer accounts, stolen card details, and refund abuse are rising. With big data tools and advanced models, fraud analytics helps detect unusual purchase behavior, safeguard payment systems, and protect businesses from revenue loss while ensuring customer trust.

- E-commerce fraud includes account takeovers, fake returns, fraudulent purchases, and chargeback scams, causing major losses for sellers and platforms.

- Data analytics in Retail uses fraud detection tools to analyse behavioral analysis, anomaly detection, and machine learning to flag suspicious activity, protect transactions, and reduce risks.

Fraud analytics in healthcare

In the healthcare sector, healthcare fraud includes phantom treatments, inflated billing, and misuse of patient identities. Healthcare providers can leverage fraud analytics tools to detect irregularities in medical billing and maintain regulatory compliance. Insurance companies also rely on these systems to prevent fraudulent healthcare claims, protecting resources and patient safety.

- Healthcare fraud includes false claims like billing for rendered services and upcoding, often by providers or patients, causing losses to payers such as insurers, employers, or governments.

- Data Analytics in Healthcare enables Fraud Analytics tools to detect fraud using pattern recognition, statistical analysis, and record comparisons.

In essence, fraud analytics serves as a powerful shield across industries, enabling organizations to detect risks early, protect revenues, and build stronger trust with customers and stakeholders.

The future trends of fraud analytics

The future trends in data analytics and fraud analytics lies in greater automation, artificial intelligence (AI), and predictive modeling. As fraudsters develop sophisticated methods, organizations must invest in fraud analytics software that leverages AI for real-time risk detection. Blockchain integration, advanced anomaly detection, and cloud-based fraud analytics tools will dominate future landscapes.

According to Fortune Business Insights, The global fraud detection and prevention market, valued at USD 52.82 billion in 2024, is projected to reach USD 246.16 billion by 2032, growing at a 21.2% CAGR. North America led with 41.56% share in 2024, while the U.S. market alone is expected to hit USD 53,359.7 million by 2032.

Fraud continues to challenge banking, insurance, retail, and healthcare sectors. Organizations leverage advanced fraud analytics tools like Excel, SQL, Python, Tableau, and big data for real-time detection, predictive insights, compliance, and customer trust ensuring resilience, efficiency, and protection against evolving fraud threats.

Refer to the articles below:

- How to Become a Data Analyst in India

- How much is the Data Analytics course fee in India

- Mastering Data Analytics in India

Enrolling in a Data Analyst courses in Bangalore or other major cities like Mumbai, Hyderabad, Chennai, Coimbatore, Ahmedabad, Delhi, Jaipur, Kochi, and Kolkata empowers learners with practical expertise, industry exposure, and a solid foundation for an emerging data analyst career.

DataMites Institute stands out as a premier training provider in India, delivering in-demand IT courses such as Data Science, Machine Learning, Artificial Intelligence, Python, IoT, and Data Engineering. Its industry-focused curriculum includes hands-on projects, certified internships, robust placement support, and globally recognized certifications accredited by IABAC and NASSCOM FutureSkills.

Offering both online and offline learning formats, DataMites has established a strong presence across India, providing Data Analyst training in Hyderabad and extending its reach to all major cities including Pune, Chennai, Bangalore, Ahmedabad, Coimbatore, Mumbai, Delhi, Jaipur, Kochi, and Kolkata.